PNC Bank has 2,600 branches in 19 states mostly on the East. Checking accounts offer a unique Virtual Wallet feature with financial tools to help achieve goals. Account fees are easily waived by meeting account balance or direct deposit requirements.

PNC's rate is currently.2% above PurePoint's but it's NOT worth the aggravation I have had to go through. I'll leave the $100 I funded the account with (if it ever shows up that is!) in there for the 180 days to. Fixed Rate IRA CD: 6 months to 10 years. A Fixed Rate ('Multiple Term') IRA CD offers a fixed rate with FDIC security up to the maximum permitted by law. Fixed Rate IRA CDs can be a wise savings choice for individuals seeking higher returns without risk to principal. Fixed Rate IRA CDs. Certificates of Deposit - Branch Banks 2021. A certificate of deposit (CD) is a savings product offered by a bank in which a depositor (someone who has money to put into the bank) agrees to commit a certain amount of money for a set period of time, in return for a fixed rate of interest.

Checking Account Bonuses

PNC Bank frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select States, so make sure you read the fine print carefully.

All PNC Bank checking accounts offer free online banking, bill pay, and mobile deposits.

Virtual Wallet Account

This is PNC Bank's signature product. This can be paired with any of PNC Bank's checking accounts. Here are some features:

- Checking & Savings together. You get a checking account (Spend), a short-term savings (Reserve), and high-interest savings (Growth) account. These accounts are designed to help achieve your current banking needs and short-term and long-term goals.

- Financial tools. This is the biggest perk of the Virtual Wallet account. There are a variety of financial tools to help you create a budget, keep track of your spending, set up goals, save, get 'danger days' alerts, and more.

- Automatic overdraft protection. If you overdraw your Spend account, funds from your Reserve account will automatically be transferred to cover the overdraft. If you need it, your Growth account can serve as your secondary overdraft protection account.

- Earn relationship rates. When you meet certain debit card or direct deposit requirements, you'll earn the higher relationship rate on your Growth account for the following month.

- ATM fee reimbursement. Depending on which Virtual Wallet account you have, you can have some or all of non-PNC ATM fees reimbursed.

How to Avoid PNC Bank Checking Account Fees

PNC Bank offers these standard checking accounts:

- Standard Checking. The $7 monthly service fee can be waived if you: maintain an average account balance of $500, OR have combined monthly direct deposits of at least $500, OR are age 62 or older.

- Performance Checking. The $15 monthly service fee can be waived if you: maintain an average account balance of $2,000, OR have combined monthly direct deposits of at least $2,000 ($1,000 for WorkPlace Banking or Military Banking customers), OR have a combined balance of at least $10,000 in PNC deposit accounts, loans, and investments.

- Performance Select Checking. The $25 monthly service fee can be waived if you: maintain an average account balance of $5,000, OR have combined monthly direct deposits of at least $5,000, OR have a combined balance of at least $25,000 in PNC deposit accounts and investments.

In addition to standard checking, PNC Bank also offers these Virtual Wallet checking + savings accounts:

- Virtual Wallet Checking. The $7 monthly service fee can be waived if you: maintain an average monthly balance of $500 in Spend and Reserve, OR have at least $500 in direct deposits per month to the Spend, OR are a qualified student, OR are age 62 or older.

- Virtual Wallet with Performance Spend. The $15 monthly service fee can be waived if you: maintain an average monthly balance of $2,000 in Spend and Reserve, OR have at least $2,000 in direct deposits per month to the Spend ($1,000 for WorkPlace Banking or Military Banking customers), OR have a combined balance of at least $10,000 in PNC deposit accounts, loans, and investments.

- Virtual Wallet with Performance Select. The $25 monthly service fee can be waived if you: maintain an average monthly balance of $5,000 in Spend and Reserve, OR have at least $5,000 in direct deposits per month to the Spend, OR have a combined balance of at least $25,000 in PNC deposit accounts and investments.

- Virtual Wallet Student. There is no monthly service fee with proof of active student status for 6 years.

PNC Bank offers a number of CDs with varying terms. The wide range of terms offered gives savers a lot of flexibility to meet their various short and longer-term savings goals. While you can earn higher rates for a higher balance, you can still find higher yields elsewhere.

Popular Searches

PNC Bank earned 3 out of 5 stars in Bankrate's review across its deposit products.

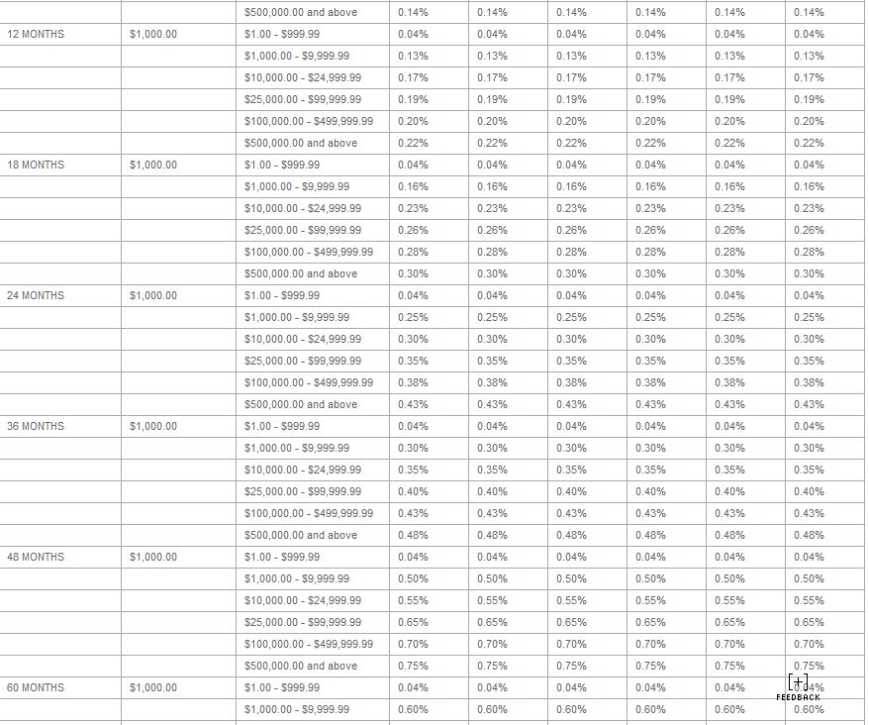

PNC CD rates

Let's take a closer look at the fixed rate CDs that PNC offers in the chart below. Note that rates vary by location and ones listed below are based on rates in New York City. The $1.00 – $999.99 tier is only for renewal.

1-month CD

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 1 month | 0.04% | 0.04% | $1-$999.99 |

| Fixed rate CD | 1 month | 0.05% | 0.05% | $1,000+ |

3-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 3 months | 0.04% | 0.04% | $1-$999.99 |

| Fixed Rate CD | 3 months | 0.05% | 0.05% | $1,000-$24,999.99 |

| Fixed Rate CD | 3 months | 0.07% | 0.07% | $25,000+ |

6-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 6 months | 0.04% | 0.04% | $1.00-$999.99 |

| Fixed Rate CD | 6 months | 0.05% | 0.05% | $1,000-$24,999.99 |

| Fixed Rate CD | 6 months | 0.o7% | 0.07% | $25,000+ |

12-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 12 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 12 months | 0.08% | 0.08% | $1,000-$24,999.99 |

| Fixed Rate CD | 12 months | 0.12% | 0.12% | $25,000+ |

18-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 18 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 18 months | 0.08% | 0.08% | $1,000-$24,999.99 |

| Fixed Rate CD | 18 months | 0.12% | 0.12% | $25,000+ |

24-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 24 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 24 months | 0.10% | 0.10% | $1,000-$24,999.99 |

| Fixed Rate CD | 24 months | 0.15% | 0.15% | $25,000+ |

36-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 36 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 36 months | 0.10% | 0.10% | $1,000-$24,999.99 |

| Fixed Rate CD | 36 months | 0.15% | 0.15% | $25,000+ |

48-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 48 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 48 months | 0.10% | 0.10% | $1,000-$24,999.99 |

| Fixed Rate CD | 48 months | 0.15% | 0.15% | $25,000+ |

60-month CDs

Which Banks Have The Best Cd Rates

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 60 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 60 months | 0.20% | 0.20% | $1,000-$24,999.99 |

| Fixed Rate CD | 60 months | 0.25% | 0.25% | $25,000+ |

84-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 84 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 84 months | 0.30% | 0.30% | $1,000-$24,999.99 |

| Fixed Rate CD | 84 months | 0.35% | 0.35% | $25,000+ |

120-month CDs

| Account | Term | Interest rate | APY | Balance required to earn interest |

| Fixed Rate CD | 120 months | 0.05% | 0.05% | $1-$999.99 |

| Fixed Rate CD | 120 months | 0.35% | 0.35% | $1,000-$24,999.99 |

| Fixed Rate CD | 120 months | 0.40% | 0.40% | $25,000+ |

Note: The APYs (Annual Percentage Yield) shown are as of June 3, 2020. The APYs for some products may vary by region.

PNC also currently offers several promotional rates on CDs.

How PNC's CD rates compare to top-yielding banks

PNC offers a variety of CD terms and and some of the bank’s terms offer decent rates. However, you can still find higher rates elsewhere. For example, Marcus by Goldman Sachs and CIT Bank offer much higher payouts on their 12-month CDs.

Be sure to compare CD rates at a number of banks before you decide where to keep your savings. By doing so, you can enjoy higher returns and meet your financial goals faster. Before making a decision, read the fine print to avoid any unwanted penalties or fees.

Pnc Bank Cd Rates 2019

Other savings options at PNC

In addition to standard CDs, PNC Bank also offers ready access CDs, callable CDs, variable rate CDs, and stepped rate CDs.

With a ready access CD, you can access your funds any time after the initial seven calendar days. Callable CDs are ideal if you'd like above-market rates for a term of 36 months or 60 months; however, the bank can call back the CD.

If you opt for a variable rate CD, you can expect an 18-month term and a rate that increases if the 3-month Treasury Bill rates go up. Lastly, the bank's stepped rate CD comes with a 36-month term and rate that climbs every six months.

Pnc Bank Cd Rates In Nj

PNC offers standard savings accounts, a high-interest savings account and money market accounts as well.